Accounting & Financial Services Franchise Opportunities Accounting Franchises For Sale

Bookkeeping

Accounting & Financial Services Franchise Opportunities Accounting Franchises For Sale

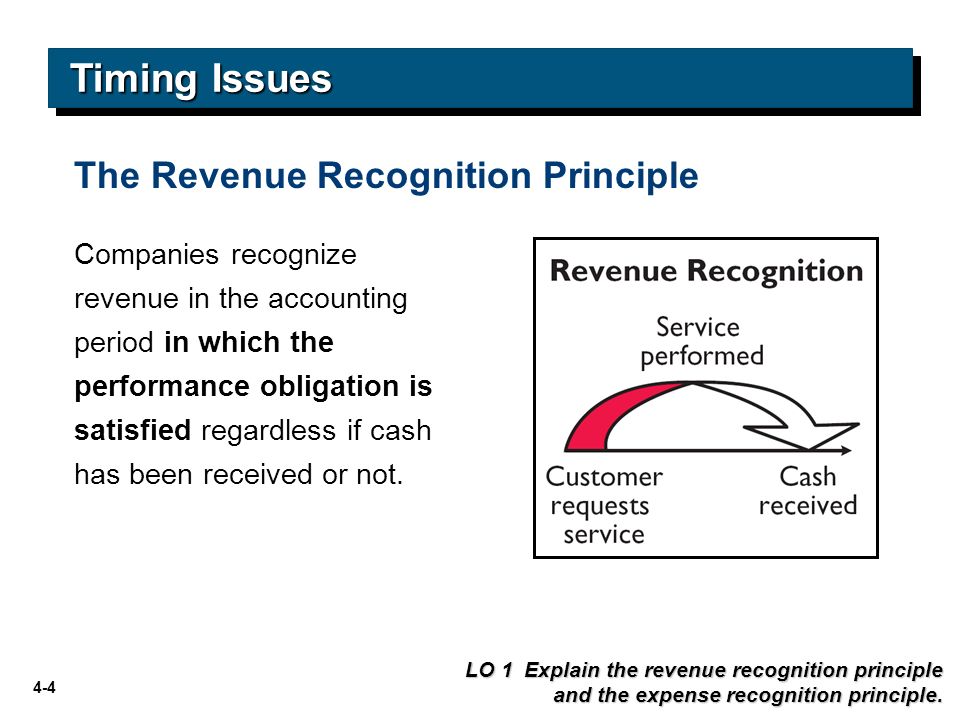

Experienced accountants can help streamline your financial processes, identify potential cost-saving opportunities, and ensure compliance with tax laws. Their expertise enables them to offer valuable insights into optimizing your financial performance and making strategic decisions for business growth. Furthermore, franchise accounting services offer confidentiality and data security measures to protect sensitive financial information. This commitment to data protection builds credibility and reassures clients of the safety of their financial data.

Investment & Success

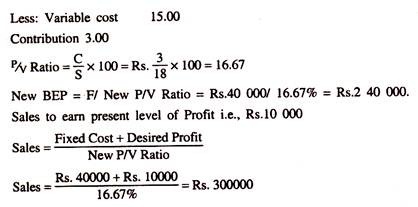

Paramount Tax and Accounting can help that financial professional launch their business quickly and grow their business rapidly using our successful business model. The second ideal candidate is the entrepreneur that wants to grow his or her business portfolio with a low cost/high return franchise that supports their other business interests. This ensures that businesses make informed decisions when pursuing growth opportunities. These firms provide guidance on financial risk management, safeguarding businesses from potential pitfalls during expansion. Managing tax return preparation efficiently can lead to cost savings and reduced risks of penalties.

Innovative Solutions

As business owners, franchisees shoud stablish key performance indicators (KPIs) to track financial performance metrics regularly. This allows for timely adjustments and ensures profitability across all franchises. Deposit verification is a critical aspect of franchise accounting services. It involves confirming that all revenues generated are correctly deposited into the business accounts. Kezos & Dunlavy provides tax, audit, accounting, consulting and payroll services to businesses and individuals in many different industries and locations. The partners at Kezos & Dunlavy have over 30 years of experience working with small and large businesses alike.

Clients’ Speaks

- By partnering with professionals like Profit Line who understand the unique financial needs of franchises, companies can streamline operations, maximize profits, and ensure long-term sustainability.

- We develop strong client relationships because it is the best way to deliver exceptional advice.

- Utilize accounting software to streamline processes such as payroll management, invoicing, and expense tracking.

Franchisees also need accounting partners who can provide full-integration to franchisor dictated systems. Franchisees need an accounting partner who can integrate with these systems for access to their full financial picture. Understanding your accounting data is critical to understanding the health of your business. It provides tlm support 2021 insights about vendor errors, staffing efficiencies, inventory management and forecasting. Without a dedicated account manager, you’re left to make sense of your accounting data without the context that can be offered by a financial pro. Creating a cash flow statement is a vital component of budgeting in franchise accounting.

Accurate Financials

The practice works closely with the owners, operators, controllers and CFOs of a wide range of franchisors, helping them establish their brand, and growing their businesses to the next level. Since franchisees are looking to enter a growing industry and do rewarding work, many decide to start their own cost reduction consulting franchise. By becoming a franchisee with P3 Cost Analysts, franchisees can reach their business ownership goals while having world-class support along the way.

Operations Reporting

Franchise accounting firms are known for their reliable and trustworthy services that instill confidence in business owners. They adhere to industry regulations and standards to ensure compliance with financial laws. Operations reporting is a vital component of franchise accounting services, offering insightful data on key operational metrics and performance indicators.

At PABS, we develop a standardized system to streamline operations, reduce costs, improve internal controls and increase profitability. We utilize cutting-edge cloud technology and industry best practices that drive better business outcomes. Using online accounting for small business can help franchise owners and franchisors communicate about the business’s finances.

If you already have an accounting background, you probably won’t need to hire an accountant. However, if you’re running a franchise, you’ll likely want to work with one so that you can focus on other aspects of your business. Professional accountants typically have a bachelor’s degree in accounting what is the accounting equation explanation or a related field along with a professional certification on top of that. Properly accounting for a franchise can be a complex matter, and you’ll often need to hire a professional. Why does this deserve a separate designation instead of being lumped in with accounting in general?

Baker Tilly is a top-ten advisory, tax and assurance firm dedicated to building long-lasting relationships with clients, communities and one another. The firm provides value to their clients by anticipating the next move and leveraging their diverse experience to provide clients with solutions, not just services. When you start a Liquid Capital franchise, you gain access to high-quality cash book: definition components and uses training programs, back-office support, ongoing mentorship, recurring revenue streams, and more. You’ll also have the opportunity to leverage Liquid Capital’s comprehensive marketing strategies and networking tactics to grow your own business. Payroll Vault mostly focuses on serving the needs of small to mid-sized businesses and your operation can be run 100% virtually.

Gone are the days of visiting client sites to help them process paper checks, or receive their paper records. For each location, the franchisor sells the rights to the franchise to individuals. When someone buys a franchised business, they already know that there’s a strong demand for their products or services.

A business opportunity (sometimes referred to as a “bizopp”) is the sale of a system the licensor has cultivated and is confident will be profitable when replicated, similar to a franchise. However, once the purchase is finalized, and training—if offered—is completed, the relationship is usually over. Because they usually don’t come with the typical training and ongoing support franchises offer, business opportunities tend to cost significantly less than franchises. The benefits of owning a franchise can be numerous vs. independent operation. Here are a few of the top benefits for those who decide to own an accounting and financial services franchise instead of going at it alone. Tax franchises can help these individuals and businesses sort through the complex tax filing process and provide a measure of peace-of-mind to their customers.

Managing payment of royalty and marketing fees is also essential for franchisee accounting. Lastly, you’ll want a partner who can help you make sense of your financials and provide clear reporting for any franchisor reporting requirements. Larger accounting firms, on the other hand, often can manage the needs of a growing business. Guardian CPA Group specializes in franchise accounting, offering you customized advice, strategies, and solutions tailored to meet the intricate financial demands of franchise businesses.

In summary, franchise accounting is a complex but necessary part of operating a successful franchise. In conclusion, the greatest method to ensure good cash flow in franchise accounting is to keep to a budget. A franchise is a business model in which an individual, known as the franchisee, purchases the rights to operate a business using the established brand, systems, and support of the franchisor. Unlike starting a business from scratch, a franchise offers a proven blueprint for success. Franchise accounting services firms like Profit Line play a pivotal role in supporting business growth by providing crucial financial insights. They assist in creating strategic financial plans to fuel expansion initiatives.

He’s curious, likes learning new things everyday and playing the guitar (although it’s a work in progress). In short, it’s not entirely necessary to hire an accountant, but it can end up saving you a lot of trouble, time, and potentially money in the long run. Accountants reconcile sales records with bank deposits to identify any discrepancies or missing transactions. Through detailed analysis and cross-referencing, accountants detect discrepancies or irregularities in expense claims promptly. Throughout the years, I have discovered that rejection is an inevitable part of entrepreneurship, and learning to embrace it is crucial for achieving success. Liquid Capital says ideal candidates should enjoy intellectual challenges, possess integrity, and have the drive to help other businesses.