Chart of Accounts Detailed Guide

Bookkeeping

Chart of Accounts Detailed Guide

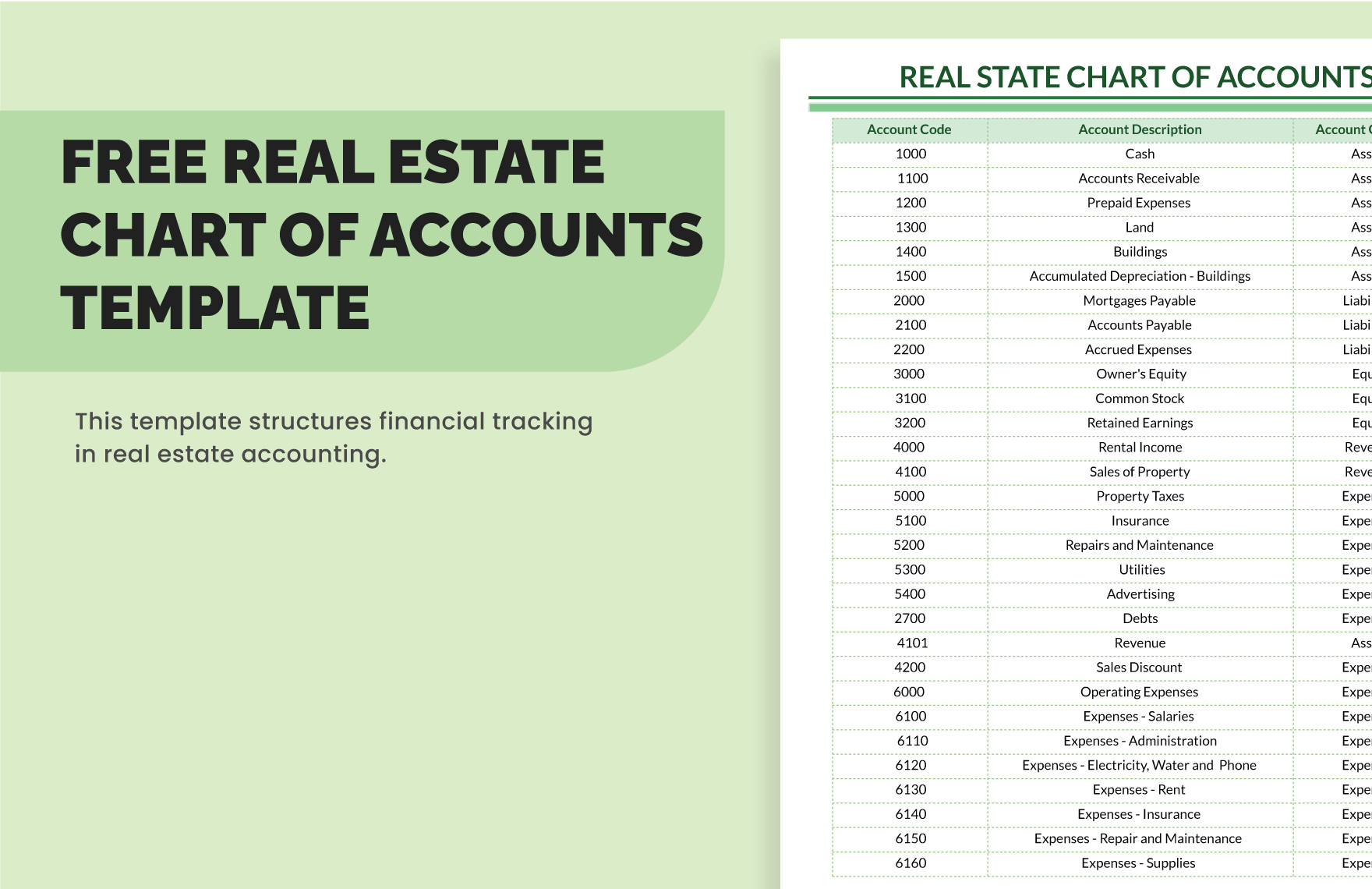

A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance. Sample Chart of Accounts are readily available for uploadfrom the Internet, or you can establish your own usingstandard default numbers and customized sub-designationsfor account types. This represents a more specific drill-down of the Account Type, for a supplementary and highly detailed view of the entry across a broader category, such as Fixed Assets.

Streamline your accounting and save time

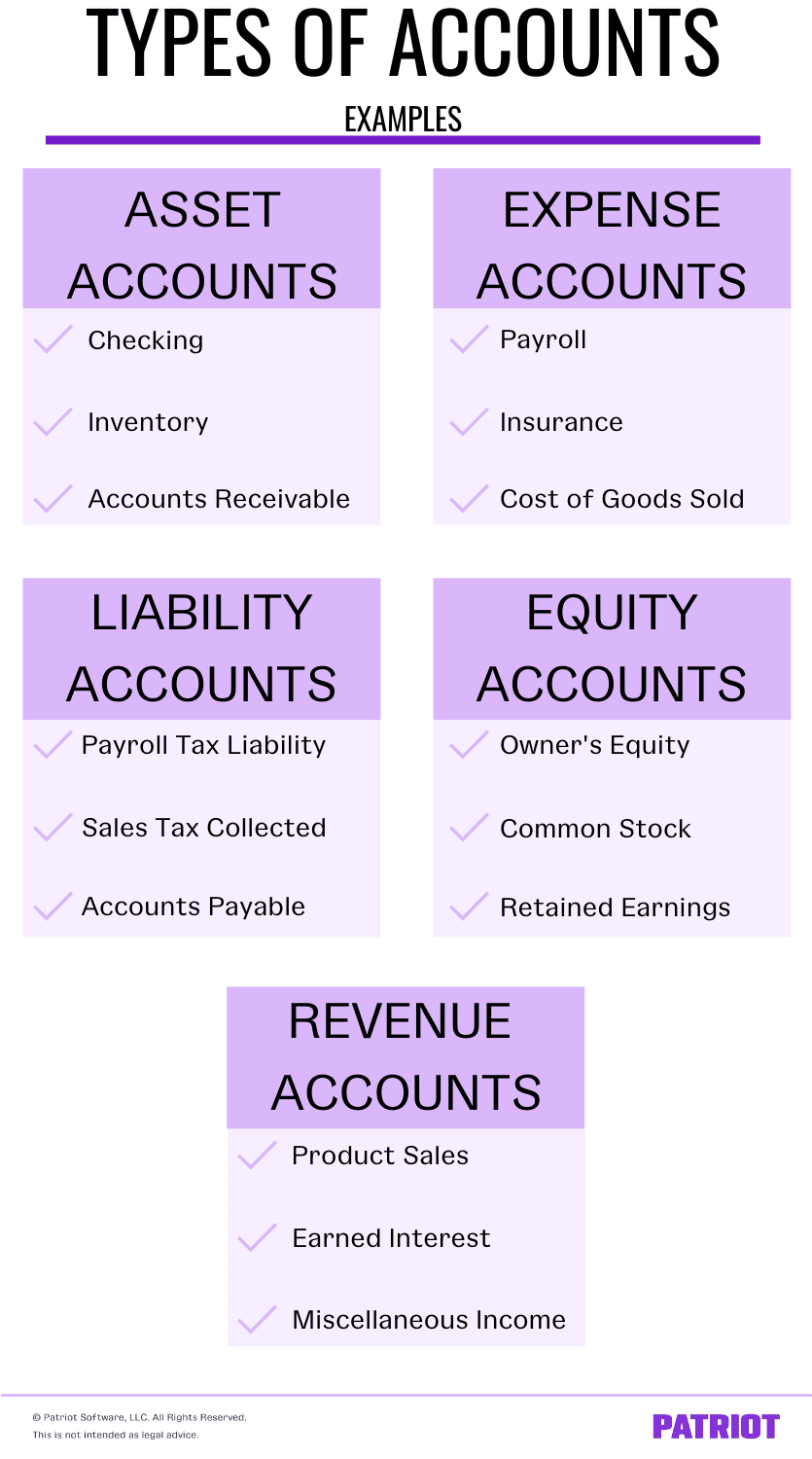

It typically includes asset, liability, equity, income, and expense accounts. A chart of accounts is a small business accounting tool that organizes the essential accounts that comprise your business’s financial statements. Your COA is a useful document that lets you present all the financial information about your business in one place, giving you a clear picture of your company’s financial health. To better understand how this information is typically presented, you may want to review a sample of financial statement. This can help you visualize how your chart of accounts translates into formal financial reporting. This structured approach allows for systematic recording and reporting, making it easier to track financial activity and prepare financial statements.

Chart Of Accounts: Definition, Types And How it Works

The relationship between journal entries and the chart of accounts is akin to the relationship between a script and its cast of characters. The COA serves as the cast—a structured list of all accounts where financial transactions can be recorded. Journal entries, on the other hand, are the script— the actual recording of financial transactions as they occur. A chart of accounts is a catalog of account names used to categorize transactions and keep your business’s financial history organized. The list typically displays account names, details, codes and balances.

How can a COA help drive my

- This makes it easier to find information and ensures that everyone in the business records transactions similarly.

- There are many different ways to structure a chart of accounts, but the important thing to remember is that simplicity is key.

- In accounting software, using the account number may be a more rapid way to post to an account, and allows accounts to be presented in numeric order rather than alphabetic order.

- Get granular visibility into your accounting process to take full control all the way from transaction recording to financial reporting.

Business needs and regulations change over time, so it’s important to review your COA periodically to ensure it continues to meet your business requirements. This might involve adding new accounts, removing redundant ones, or restructuring sections to improve clarity business succession planning and functionality. Maintain consistency in how transactions are recorded and categorized. This consistency should extend across all accounts to ensure that the data is comparable and reliable. Regular training sessions for staff can help achieve this consistency.

Easy-To-Use Platform

When you log in to your account online, you’ll typically go to an overview page that shows the balance in each account. Similarly, if you use an online program that helps you manage all your accounts in one place, like Mint or Personal Capital, you’re looking at basically the same thing as a company’s COA. A chart of accounts (COA) is an index of all of the financial accounts in a company’s general ledger.

This list will usually also include a short description of each account and a unique identification code number. It is a very important financial tool that organizes a lot of financial transactions in a way that is easy to access. Because transactions are displayed as line items, they can quickly be found and assessed. This is crucial for providing investors and other stakeholders a bird’s-eye view of a company’s financial data. For example, a company may decide to code assets from 100 to 199, liabilities from 200 to 299, equity from 300 to 399, and so forth.

This structure enables businesses to organize their financial transaction records clearly and systematically. Start with a simple COA structure that covers all the fundamental areas of your business finances but is also flexible enough to scale as your business grows. Avoid creating too many specific accounts initially; instead, add them as your business needs evolve. The chart of accounts can vary from one business to another, but they generally fall into five major categories based on the business’s needs and operational complexity. Understanding these types can help businesses choose or design a COA that best fits their accounting requirements.

This significantly aids organization in financial analysis, compliance, and decision-making. Over time, just by looking at the folders and your expense categories, you would understand where most of your money is coming from and going to. It makes sure that there’s a place for every financial detail, which helps in creating reports, preparing taxes, and making decisions about the future of the business. A chart of accounts has accounts from the balance sheet and income statement and feeds into both of these accounts.